Egypt Electronic Invoicing and E-Receipt

Integrate your ERP / Accounting Software with ETA E-Invoicing Portal

Orion end-to-end e-invoicing solution meets 100% of the Egyptian Tax Authority requirements including digital signature. Our solution is deployed on-premise and can be customized to meet your company’s IT and security requirements.

Our solution loads invoice data directly from an xlsx or csv file that has been extracted directly from the ERP system, or it can read invoice details directly from a database table. This approach allows for a fully automated process without having to make any complex integrations with your ERP system.

Orion e-Invoice Solution High Level Functionality

Orion’s Solution will load Invoices, Credit Notes and Debit Notes from a database table or an external file (generated from ERP system), then submit them to the tax authority e-invoicing system.

The solution will be deployed on a physical machine on-prem.

The solution is built using Microsoft Dot Net / SQL Server as a middleware console application.

ORION E-INVOICE AND E-RECEIPT SOLUTION FEATURES

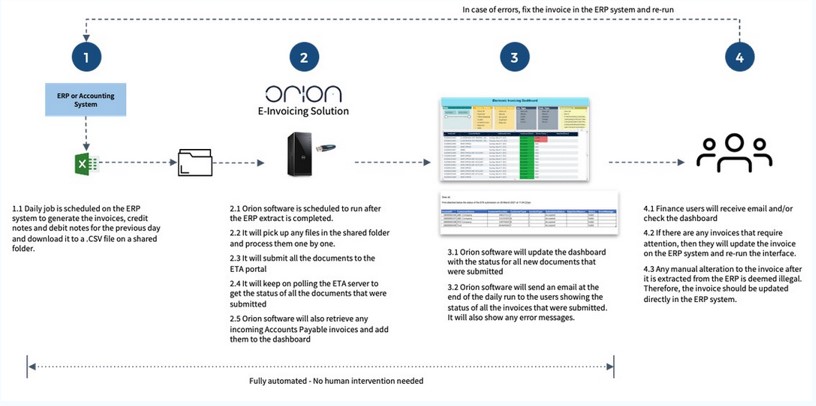

HOW IT WORKS

ORION E-INVOICE AND E-RECEIPT TECHNICAL FEATURES

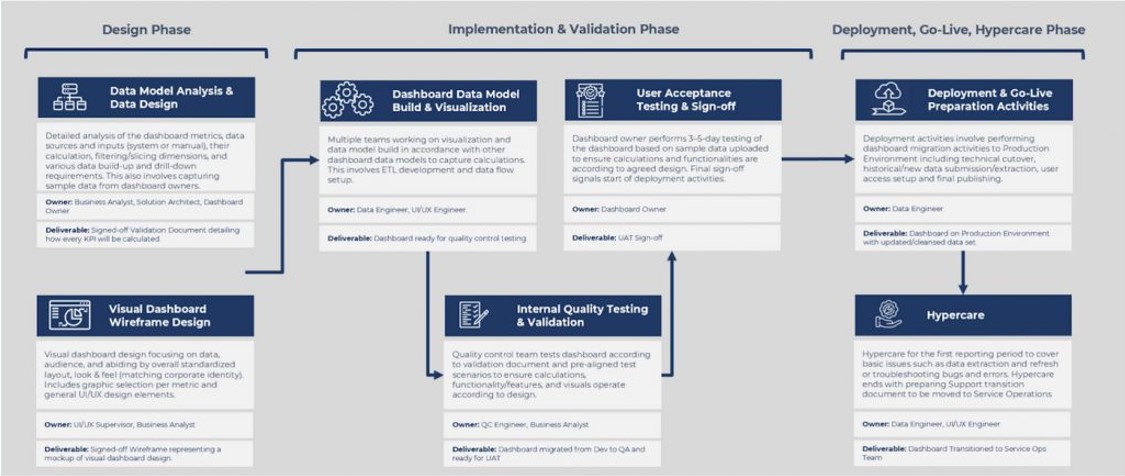

ORION ENGAGEMENT MODEL

SAMPLE DASHBOARDS

Why Work With Us?

CUSTOMER SUCCESS

FAQ

- Increased efficiency: e-Invoicing can help businesses save time and money by automating the invoicing process.

- Improved accuracy: e-Invoicing can help reduce errors in invoicing by providing a more structured and controlled process.

- Increased compliance: e-Invoicing can help businesses to comply with tax regulations by providing a more auditable trail.

- Improved customer service: e-Invoicing can help businesses to improve customer service by providing a faster and more efficient way to issue invoices.

- Register with the Tax Authority's e-invoicing system.

- Use/develop an e-invoicing solution.

- Issue all invoices electronically.

As per ETA:

- Fines of up to EGP 100,000.

- Imprisonment of up to 3 years.

- Revocation of the business's license to operate.